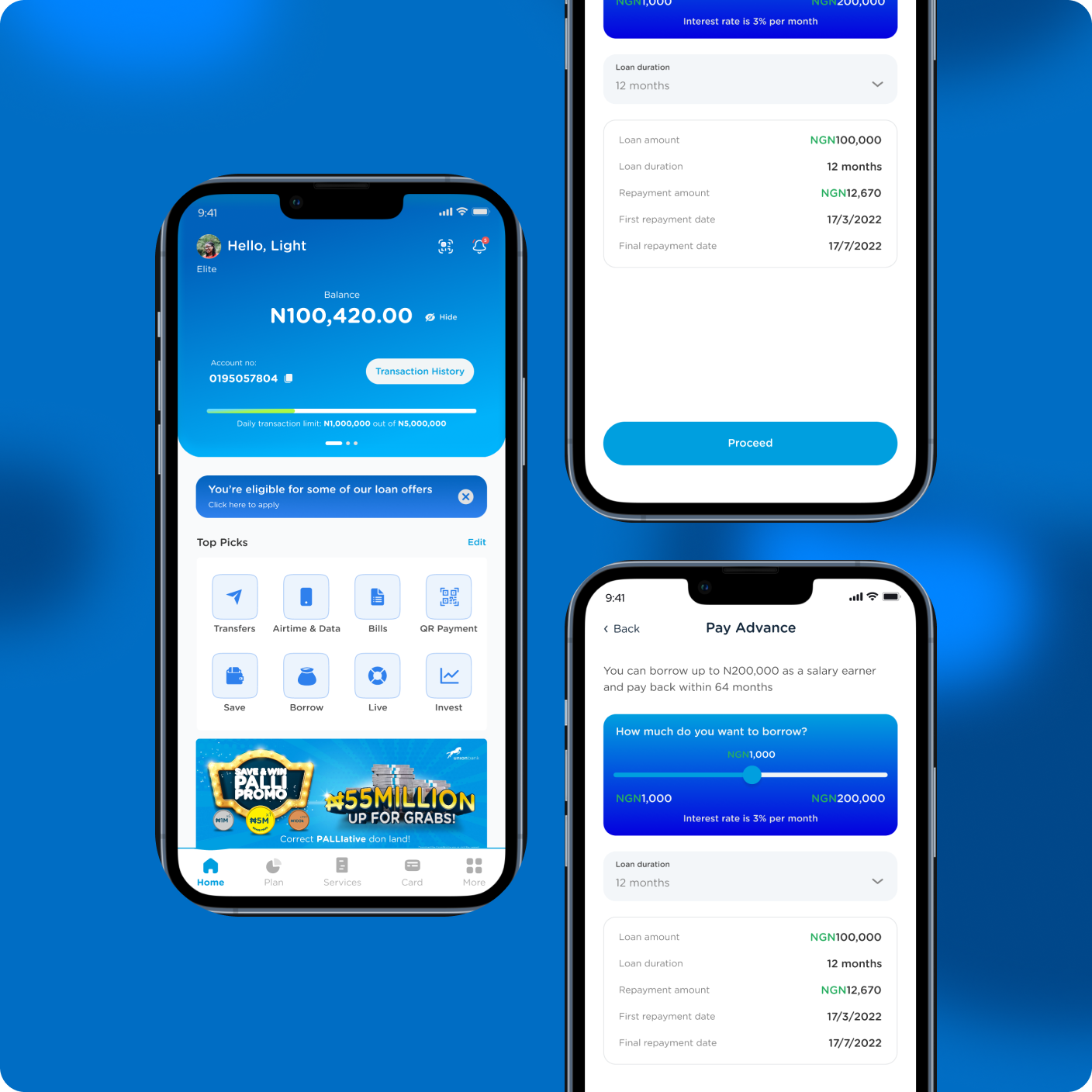

Digital Loans Experience

MY ROLE

Product Designer

Industry

Banking/Lending

Description

Union Bank’s had a goal to capture the younger demographic on their digital channels (from NYSC corpers to working professionals). One of the tactics in their strategy was to modernise how they offered loans. The bank historically relied on a fully manual process, using physical documentation and Excel sheets to evaluate loan eligibility and process disbursement.

Recognising that their consistent and effective, yet unscalable manual process was holding them back, the bank aimed to develop a digital solution that would streamline loan disbursement.

As the sole designer on the project, I was tasked with the end-to-end design of the project. From research through UX/UI design, prototyping, and testing. I reported to the lead designer and Head of Retail Department, I worked closely with key stakeholders, especially the retail loans team, to ensure that the product not only looked great but solved real business challenges.

Process and Approach

To build a robust MVP suited for a younger demographic, I structured my approach around solid user and stakeholder insights:

User Research

The business had decided that the product should be tailored towards the younger demographic, so I took my time to understand what the business had to offer versus what users real pain points, preferences, and expectations for a digital loan application experience were. These insights helped me to better structure my solution to the problem.

Business Expectations

- A seamless end-to-end process to replace existing flow.

- Backoffice tool to manage loan requests and users.

- A scalable option beyond efficient excel.

- More borrowers

Customer Pain Points

- Lengthy and Cluttered Forms: Traditional loan applications that require filling out too many fields, often repeating information that’s already on file.

- Confusing Eligibility Criteria: Applicants don’t usually get the exact requirements for loan approval, leading to uncertainty, hesitation and decline.

- Slow Processing Times: Most traditional bank issued loans can’t cater to emergencies.

- Lack of Transparency: The breakdown of fees, costs, and repayment terms are usually vague till it is time to pay.

Design Approach

I drafted simple, low fidelity screens to describe the user flow that enabled customers to quickly check their eligibility with the engineers and product owners. The flow was designed to reduce friction and deliver a modern, efficient experience.

Upon review of the flow with the engineers and product owners, we ideated a better and more seamless approach to the process by creating a pre-approval system. This meant that the engineers would automate the approval process from the database based on eligibility parameters and the customers would be notified of their eligibility before they even applied.

This approach would serve as both a marketing effort and process starter. With this in mind, I fine-tuned the user flow to cater to this, making it far more straightforward.

Emphasis on Transparency

From my low fidelity designs, I chose to prominently present fee structures, and repayment details within the application process. This decision was essential to create clarity and build trust among users and provide clear expectations right from the outset.

Seamless enough for the demographic

We cut back our process steps by prompting users from their dashboard to request for loans since they have been certified eligible backend. The aim was to creatively eliminate dropoffs for a set of users known to have short attention spans.

Scalable Process Design

The flow was optimised to cater to other loan types; with this experience, we aimed to get all types of customers to take loans with us in as quickly as 3 easy steps.

Testing

From guerrilla tests on the low fidelity wireframes validating the plan structured out in the design, to another round of tests with more stakeholders and product owners to review what the result looked like.

App content/copy recommendations were made by the UX writing team of the communication department, after which the final designs were presented to the bank’s management for approval and recommendations.

Gains, Learnings and Future Plans

I had to learn a different approach to get buy-in for my design ideas. I was having to deal with industry experts in different banking areas, as well as management staff who were not keen on taking a lot of risk to give out loans at scale to customers who they didn’t deem fit. I leveraged information gained from competition, metrics on potential gains from exploring the venture, as well as how risk was to be averted with our designed flows to get buy in from relevant stakeholders.

I gained key insights into the lending space – both from the banking perspective as well as fintech perspective. It was an interesting task to marry all that information to birth ideas that would leverage the strengths of both sides.

I had to prototype a lot and make changes on the go as I was working with stakeholder feedback to fine-tune my work within a short time, before having to present to management. We succeeded in getting approval for development. Yay!