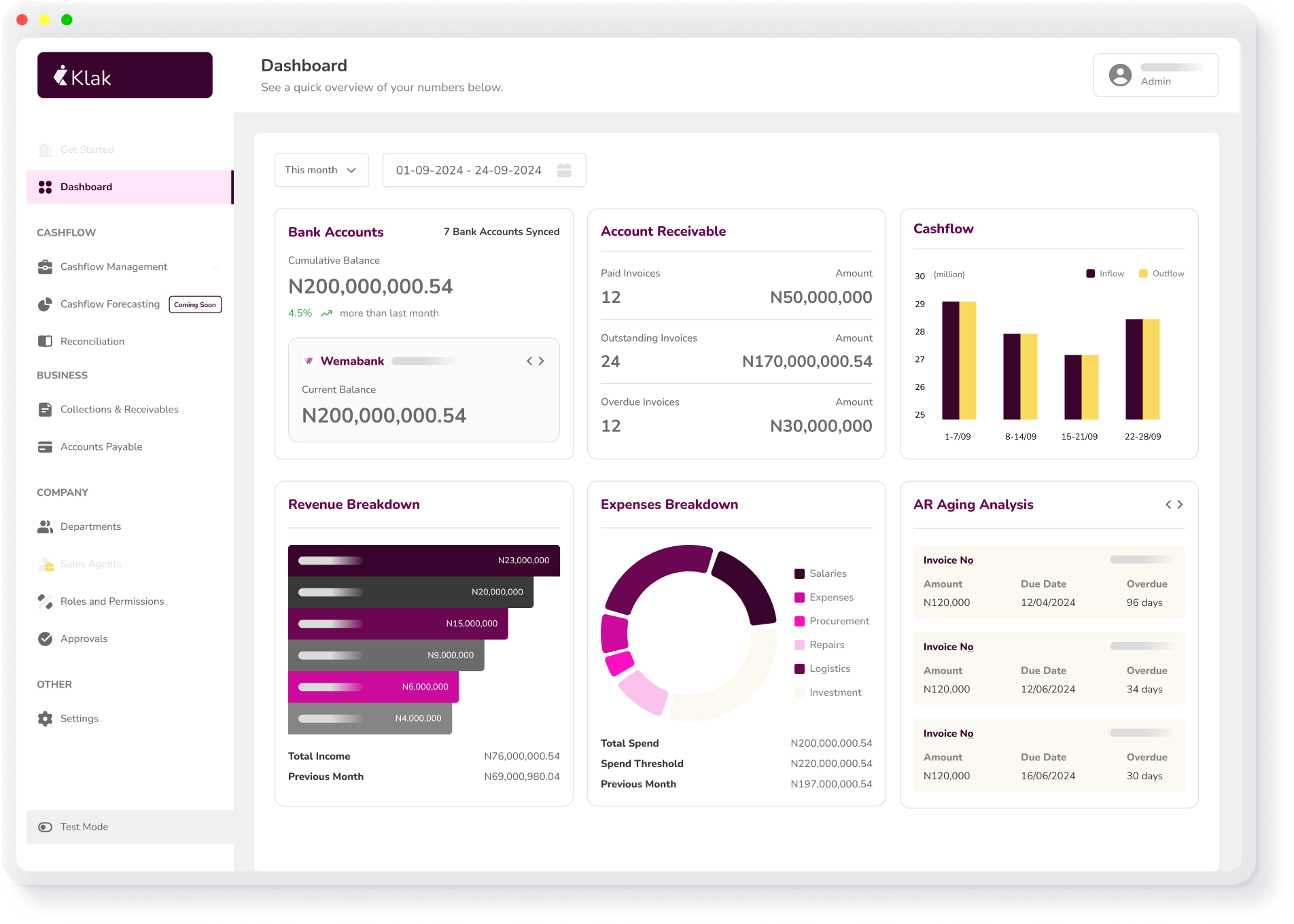

Finance Workflows Automation for Businesses

Since 2024

Client

Klak

Summary

Two serial entrepreneurs discovered potential value in helping finance teams do their work more efficiently. Finance people deal with a lot of figures and there are a number of core processes that remain manual, fragmented, and time-consuming. These include procurement, accounts receivable and payable, cash flow management, and financial forecasting.

The idea was to build a unified platform that automates these workflows, improves visibility, and enables finance teams to focus on strategic decision-making rather than repetitive tasks. By simplifying complex financial operations, the product aimed to reduce errors, accelerate processing times, and give leadership real-time insights into the company’s financial health

What We Built

A robust subscription based SaaS application

Designed to help finance teams streamline and

automate core financial workflows

The product supports end-to-end procurement, accounts receivable and payable, and cashflow forecasting—all in one place

Procurement Workflow Automation

I created workflows to help businesses automate the entire process of procurement from requisition to payment, streamlining approvals, minimizing delays, and improving operational efficiency by over 30%.

Receivables and Payables Automation

I designed workflows to help businesses automate their accounts receivable and payable processes — from invoice generation and approvals to reconciliation and payment tracking. This reduced manual errors, improved collection and payment cycles, and gave finance teams real-time visibility into cash flow.

Cashflow Management

I designed workflows to help businesses gain real-time visibility and control over their cashflow. By automating tracking, categorization, and forecasting, finance teams could anticipate liquidity gaps, align spending with revenue cycles, and make proactive business decisions.

The Results

The team was so satisfied with the outcome of this design. It satisfies expectations to the extent that the selling point of the business is 30% more efficiency or next month free.

Learning

Within weeks of launch, the business had onboarded up to 4 teams. We continued to iterate and add useful features to the product based on user feedback, as well as finetune the pricing model.

I learned a lot in terms of pricing design – the art of accommodating business expectations while preventing friction with users in form of paywalls or unnecessary limitations.